IL ST-556-X 2015-2024 free printable template

Show details

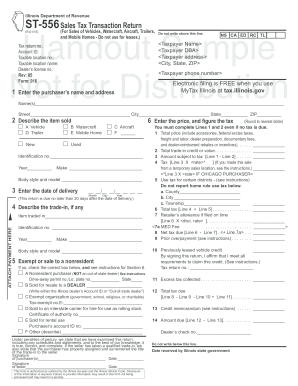

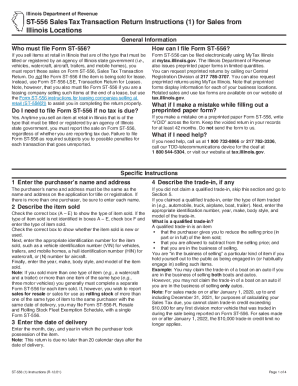

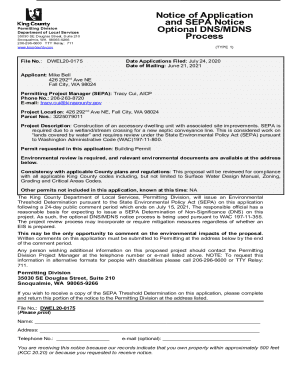

Illinois Department of Revenue ST-556-X Amended Sales Tax Transaction Return For Sales of Vehicles Watercraft Aircraft Trailers and Mobile Homes - Do not use for leases Rev 05 Form 017 Station 312 E S // NS CA DP RC TL EC Read this information first Do not write above this line. The correct a Sold to a nonresident purchaser see instructions name is. Drive-away permit no. 7 I am claiming credit for tax that was previously paid to an Lic. plate no. State Illinois retailer or directly to the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your st556x form 2015-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your st556x form 2015-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing st556x form online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit illinois st 556 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

IL ST-556-X Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out st556x form 2015-2024

01

To fill out st556x, you need to start by gathering all the necessary information and documents. This includes the legal name, address, and contact details of the person or organization for whom the form is being filled out.

02

Once you have the required information, proceed to carefully read each section of the st556x form. It is essential to understand the instructions and requirements for each field. If you have any doubts or questions, refer to any accompanying guidelines or seek professional assistance.

03

Begin filling out the form by accurately providing the requested information in each corresponding field. This may include details about the type of business or organization, identification numbers, and other specific data required for proper completion of the form.

04

Double-check all the entries made on the st556x form to ensure accuracy and completeness. Mistakes or incomplete information can cause delays or complications in the process.

05

After reviewing and confirming the filled-out form, sign and date it as required. In some cases, additional signatures or certifications may be necessary from authorized individuals or entities.

Who needs st556x?

01

The st556x form is typically required by individuals or organizations involved in various business transactions, particularly those related to sales and use taxes.

02

Businesses that sell taxable goods or services, wholesalers, retailers, and other entities engaged in commerce may need to fill out the st556x form to comply with tax regulations.

03

Additionally, individuals or organizations seeking tax exemptions or special permits related to sales and use taxes may also be required to submit the st556x form as part of their application process.

Fill illinois st 556 amended sales transaction printable : Try Risk Free

People Also Ask about st556x form

What tax forms do I need for Illinois?

How do I report sales tax in Illinois?

How do I claim my sales tax refund in Illinois?

What is the sales tax in the state of Illinois?

What is the schedule GT form in Illinois?

What is a rut 25 form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is st556x?

ST556x is a series of programmable Multi-Interface Controllers (MIC) manufactured by STMicroelectronics. These controllers are used in embedded systems, IoT applications, automotive systems, and other industrial applications. The ST556x series features a 32-bit ARM Cortex-M0 core, up to 1MB Flash memory, up to 192KB RAM, and multiple serial communication interfaces, including CAN, I2C, SPI, UART, and LIN.

How to fill out st556x?

ST556x is a form used by the California Employment Development Department (EDD) to report employee wages. The form must be completed and submitted for each employee and includes information such as the employee's name, address, Social Security Number (SSN), wage information, and other relevant data.

To fill out the ST556x form, follow the instructions below:

1. Enter the employer’s name and address at the top of the form.

2. Enter the employee’s name, address, Social Security Number (SSN) and other basic information.

3. Enter the employee’s wages for the period reported.

4. Enter additional information such as the employee’s occupation, withholding status, exemptions, and other deductions.

5. Calculate the total wages, deductions, and net pay.

6. Sign the form, print the date, and submit.

What is the purpose of st556x?

ST556x is a series of microcontroller integrated circuits manufactured by STMicroelectronics. They are used in embedded systems to provide control, monitoring, and communication functions. The ST556x series is based on the ARM Cortex-M0+ processor core and includes a variety of features, including multiple I/O interfaces, integrated analog peripherals, and low-power modes.

What information must be reported on st556x?

ST556x is a form used to report information related to the dividends paid by a corporation to its shareholders. Specifically, it should include the name of each shareholder, the amount of dividends paid, the date the dividends were paid, the type of dividend paid, and the tax year in which the dividend was paid. Additionally, the form should also include the name and address of the issuing corporation and the total amount of dividends paid by the corporation for the tax year.

What is the penalty for the late filing of st556x?

The penalty for late filing of the ST556X form is a minimum penalty of $50 or 5% of the amount due, whichever is greater. In addition, there is an additional penalty of 0.5% of the amount due for each additional month the return is late, up to 25%.

Who is required to file st556x?

ST-556-X is a form used to report the sales tax on the purchase of a motor vehicle or watercraft in the state of Illinois, USA. It is typically filed by the purchaser of the vehicle or watercraft.

How can I edit st556x form from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including illinois st 556 form. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I fill out the st 556 form pdf form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign st556x and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I complete st556 on an Android device?

Complete st 556 x form and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your st556x form 2015-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

St 556 Form Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to st 556 form download

Related to illinois st 556 x form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.