IL ST-556-X 2015-2025 free printable template

Show details

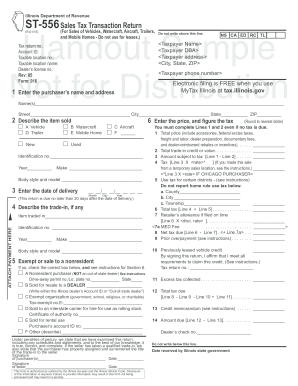

Illinois Department of Revenue ST-556-X Amended Sales Tax Transaction Return For Sales of Vehicles Watercraft Aircraft Trailers and Mobile Homes - Do not use for leases Rev 05 Form 017 Station 312 E S // NS CA DP RC TL EC Read this information first Do not write above this line. The correct a Sold to a nonresident purchaser see instructions name is. Drive-away permit no. 7 I am claiming credit for tax that was previously paid to an Lic. plate no. State Illinois retailer or directly to the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign st 556 form

Edit your st 556 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your illinois 556x sales tax transaction make form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing st556 online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit illinois st556 x amended sales return sample form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL ST-556-X Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out illinois st 556x sales tax form printable

How to fill out IL ST-556-X

01

Begin with the header section, filling in the title 'Illinois Department of Revenue - Form ST-556-X'.

02

Enter your name and address in the designated fields.

03

Provide the original ST-556 number on which you are seeking a refund or adjustment.

04

Explain the reason for the amendment in the designated area.

05

Calculate the amount of tax overpaid or underpaid; fill in the required financial details.

06

Sign and date the form at the bottom to affirm correctness.

07

Submit the form to the appropriate address as per the instructions provided.

Who needs IL ST-556-X?

01

Persons or entities that have filed an incorrect or amended ST-556 form and need to correct their tax information.

02

Anyone claiming a refund for overpayment of sales tax in the state of Illinois.

03

Sellers or retailers who need to adjust their tax obligations for various reasons including errors in original reporting.

Fill

st556x amended sales return form blank

: Try Risk Free

People Also Ask about il st 556 x sales transaction form blank

What tax forms do I need for Illinois?

2022 Individual Income Tax Forms FormDescriptionIL-1040-VPayment Voucher for Individual Income TaxIL-1040-X-VPayment Voucher for Amended Individual Income TaxIL-505-IAutomatic Extension Payment for Individuals Filing Form IL-1040IL-1310Statement of Person Claiming Refund Due a Deceased Taxpayer19 more rows

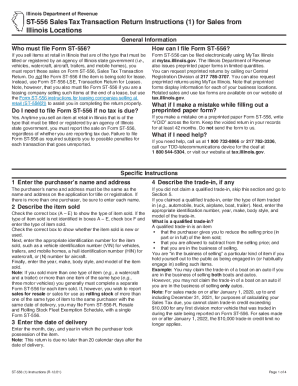

How do I report sales tax in Illinois?

You can file Form ST-1, Sales and Use Tax and E911 Surcharge electronically using MyTax Illinois to report your sales and use tax liability. If you are reporting sales for more than one location or from a changing location, you must also submit Form ST-2, Multiple Site Form.

How do I claim my sales tax refund in Illinois?

You should file Form ST-6, Claim for Sales and Use Tax Overpayment/Request for Action on a Credit Memorandum, if you are a registered retailer who has • a sales and use tax overpayment on file and you want to - convert this overpayment to a credit memorandum, or - convert it to a credit memorandum and transfer

What is the sales tax in the state of Illinois?

The Illinois' general state sales and use tax rates are: 6.25 percent on general merchandise, including items required to be titled or registered by an agency of Illinois state government; and. 1 percent on qualifying foods, drugs, and medical appliances.

What is the schedule GT form in Illinois?

Schedule GT was specially created for retailers to report sales of qualifying items sold during the sales tax holiday. This schedule should be filed with your Form ST-1, Sales and Use Tax, and E911 Surcharge Return.

What is a rut 25 form?

You must complete Form RUT-25, Vehicle Use Tax Transaction Return, if you are titling or registering in Illinois a motor vehicle, watercraft, aircraft, trailer, mobile home, snowmobile, or all-terrain vehicle (ATV) that you purchased from an unregistered out-of-state dealer or retailer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit illinois st556x return form pdf from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including il st 556 x form get. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I fill out the illinois st556 amended sales tax transaction form form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign il st 556x amended transaction return printable and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I complete st556x form on an Android device?

Complete 556 x form and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is IL ST-556-X?

IL ST-556-X is a form used to amend a previously filed Illinois Sales Tax Return.

Who is required to file IL ST-556-X?

Any individual or business that has made a mistake on their previously submitted Illinois Sales Tax Return is required to file IL ST-556-X.

How to fill out IL ST-556-X?

To fill out IL ST-556-X, one should provide the correct information in the required fields, including the tax period, corrections, and any necessary explanations for the changes.

What is the purpose of IL ST-556-X?

The purpose of IL ST-556-X is to correct errors or omissions made on prior sales tax returns and ensure accurate reporting of tax liabilities.

What information must be reported on IL ST-556-X?

The information that must be reported includes the original figures from the previously filed return, the corrected figures, an explanation of the changes, and any penalties or interest applied.

Fill out your IL ST-556-X online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

St 556 X is not the form you're looking for?Search for another form here.

Keywords relevant to st 556 x form

Related to printable st 556 form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.